high risk life insurance policy High risk life insurance

High-risk life insurance is a specialized form of insurance designed for people with pre-existing medical conditions or high-risk lifestyles. By purchasing a high-risk policy, you can protect your family and gain peace of mind knowing that you have a policy in place should an unexpected illness or accident occur. Navigating the world of high-risk life insurance can be confusing, but understanding the basics is the first step to finding the right policy for your needs.

What is High-Risk Life Insurance?

High-risk life insurance is a type of insurance specifically designed for those with more complicated health and lifestyle backgrounds. It is typically characterized by higher premiums than traditional life insurance policies in exchange for more comprehensive coverage. This type of insurance is designed for a person who may have a pre-existing medical condition or engage in high-risk activities such as skydiving or motorcycle riding. Not everyone qualifies for this type of coverage, but there are insurers who specialize in providing the high-risk coverage many individuals need.

What Benefits Does it Offer?

One of the primary benefits of high-risk life insurance is that it provides financial security for your family. In the event of an unexpected illness or accident, a high-risk policy can help provide your loved ones with financial help. It can also help you to provide for future generations and allow your children and grandchildren to benefit from your policy and the protection it provides. Additionally, high-risk policies can be tailored to your unique needs and can provide various financial benefits such as burial insurance and disability income.

How to Choose the Right Policy?

When it comes to selecting a high-risk policy, it's important to take the time to research various providers and compare the policies they offer. Be sure to read the policy language carefully and make sure you understand your coverage, exclusions, and any potential riders. It's also important to consider the cost of the policy and make sure you can afford the premiums. Additionally, it's wise to look for a policy that can provide you with the financial protection you need now as well as adjust to changes in your finances and lifestyle in the future.

Is There Affordable Coverage Available?

Yes, there are many insurers that offer affordable high-risk life insurance plans. It's important to understand that premiums can vary widely from one insurer to another. It's also important to take the time to compare various plans and make sure you understand the coverage they provide and the exclusions they include. Be sure to check with your insurer to determine if any discounts are available and ask about any other options to help reduce your premium.

Conclusion

High-risk life insurance is a way for individuals with a challenging health situation or lifestyle to gain financial security. Although it can require some research to identify the appropriate insurance provider and policy, it is possible to find a plan that will provide the financial protection your loved ones need. By investigating the various options available and talking to an experienced insurance professional, you can find an insurance plan that is tailored to your unique needs.

If you are looking for What Everybody Ought to Know About Insurance-SageOak Financial Blog you've visit to the right place. We have 7 Images about What Everybody Ought to Know About Insurance-SageOak Financial Blog like Get High Risk Life Insurance for Seniors | Life insurance for seniors, High Risk Life Insurance Articles | High Risk Life Insurance and also High risk life insurance. Read more:

What Everybody Ought To Know About Insurance-SageOak Financial Blog

www.sageoakfinancial.com

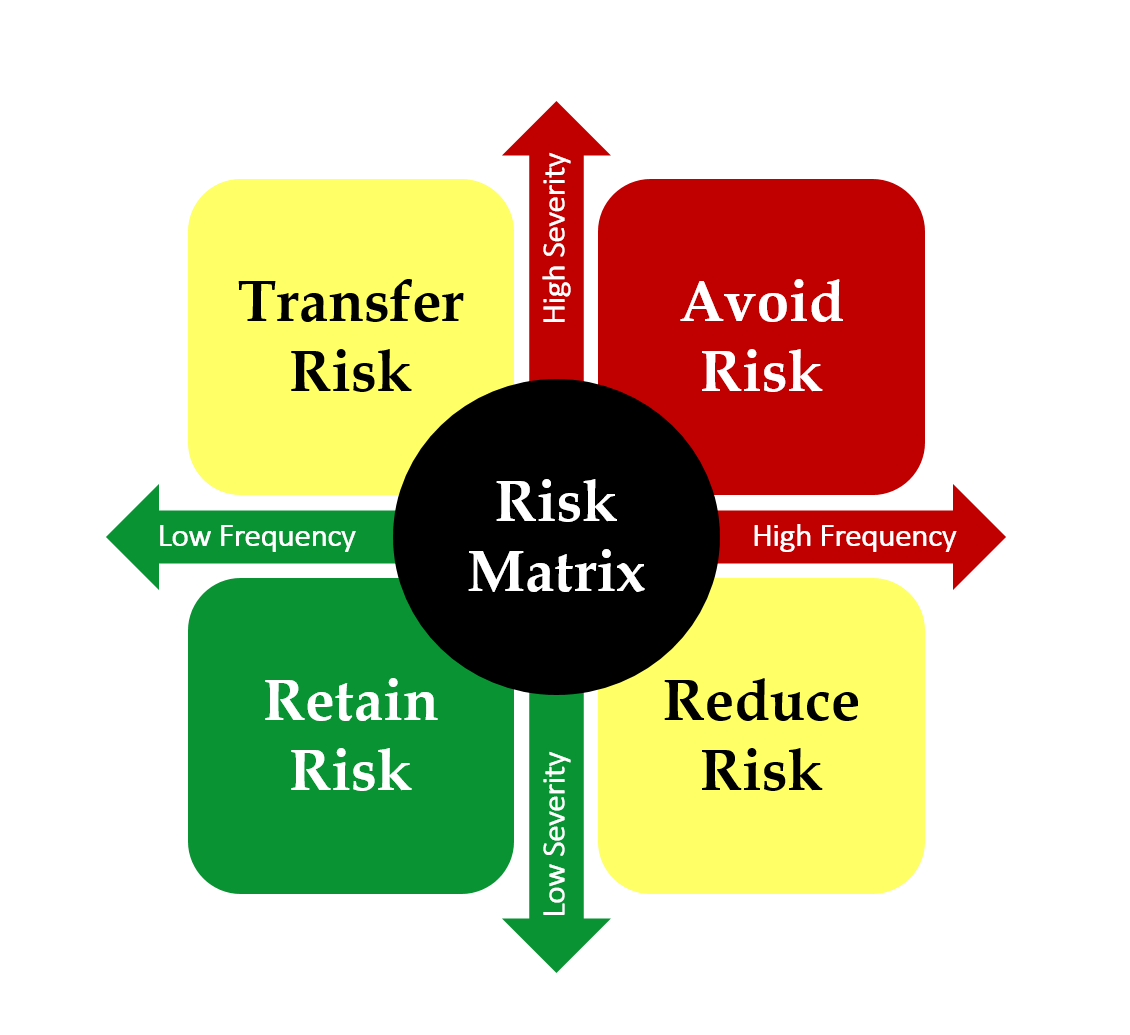

www.sageoakfinancial.com insurance risk matrix dealing ought everybody know financial four wise purchasing certain consider type

Affordable High Risk Life Insurance? It's Possible Despite Medical Issues!

www.policyarchitects.com

www.policyarchitects.com High Risk Life Insurance Articles | High Risk Life Insurance

www.spectruminsurancegroup.com

www.spectruminsurancegroup.com conditions

Get High Risk Life Insurance For Seniors | Life Insurance For Seniors

www.pinterest.com

www.pinterest.com seniors

High Risk Life Insurance

insurance risk slideshare

What Is High-risk Life Insurance? | Senior Life Services

senior-lifeservices.com

senior-lifeservices.com risk insurance senior waiting period there

High Risk Life Insurance | Are You Really High Risk?

millennialmoney.com

millennialmoney.com risk insurance

High risk life insurance. Insurance risk slideshare. Insurance risk matrix dealing ought everybody know financial four wise purchasing certain consider type

Comments

Post a Comment