deferred compensation life insurance Business life insurance, the truth about deferred compensation plans

When deciding what is best for your business, review the benefits and disadvantages of a deferred compensation plan to ensure the best and most financially responsible decision is made.

What Is A Deferred Compensation Plan?

A deferred compensation plan is a type of savings plan that defers payment of income offered to certain employees. While it may be used to attract and retain top executive talent, it must follow all the guidelines of Section 409A of the Internal Revenue Code of 1986. The deferred plan typically requires employers or employees to make contributions to a retirement or savings account. These contributions are taxed on a different schedule than other contributions which allows employees to reduce their current taxable income.

Benefits Of A Deferred Compensation Plan

Deferred compensation plans have several advantages, including:

- Tax deferral: Contributions to the plan are not taxed until they are withdrawn.

- Flexibility: Employees can decide how much to invest and which deferred compensation plan to use.

- Protection against creditors: The money in the plan is not subject to claims by creditors.

- Simplicity: The plan does not require complex paperwork.

- Low fees: Unlike standard retirement plans, most deferred compensation plans have low costs.

Disadvantages Of A Deferred Compensation Plan

Deferred compensation plans also have a few drawbacks, including:

- Restrictions: Contributions are subject to certain restrictions, including annual contribution limits.

- Risk: Your investment may lose value if the market fluctuates.

- Taxes: Both employer and employee contributions to the plan are subject to taxes.

- No capital gains: Any capital gains will be taxed as ordinary income.

Conclusion

Deferred compensation plans can be a great way to save for retirement but employers and employees must understand the advantages and drawbacks before making any decisions. Consider all aspects of the plan carefully, including the associated costs, potential risks and long-term financial goals. With proper planning, a deferred compensation plan can be an important part of a secure retirement strategy.

If you are searching about Business Life Insurance, The Truth About Deferred Compensation Plans you've came to the right web. We have 7 Images about Business Life Insurance, The Truth About Deferred Compensation Plans like Business Life Insurance, The Truth About Deferred Compensation Plans, Deferred Compensation – Employee Limits for 2017 - insightfulaccountant.com and also Benefits And Disadvantages Of A Deferred Compensation Plan | Investing Post. Here you go:

Business Life Insurance, The Truth About Deferred Compensation Plans

www.pinnaclequote.com

www.pinnaclequote.com deferred compensation documenten documents dividing wrinkle employee compensatie uitgestelde reportée consolidation vrijgesteld belastingen

Benefits And Disadvantages Of A Deferred Compensation Plan | Investing Post

benefits deferred disadvantages plan compensation

Deferred Compensation - Assignment Point

www.assignmentpoint.com

www.assignmentpoint.com deferred compensation

Deferred Compensation-Reward Today, Pay Later - The Art Of Financial

theartoffinancialplanning.com

theartoffinancialplanning.com Deferred Compensation – Employee Limits For 2017 - Insightfulaccountant.com

www.intuitiveaccountant.com

www.intuitiveaccountant.com deferred compensation

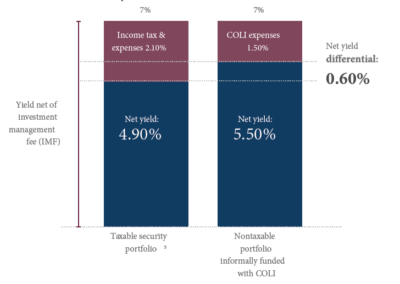

Strategies For Corporate Owned Life Insurance - Clearpoint Advisors

clearpointadvisorsllc.com

clearpointadvisorsllc.com compensation deferred strategies owned insurance corporate deferral restoring opportunity qualified lost non

Deferred Compensation | Eugene, OR Website

deferred compensation document eugene comp deferral limits committee enrollment maximum handbook changes former plan gov

Business life insurance, the truth about deferred compensation plans. Deferred compensation. Deferred compensation

Comments

Post a Comment