do life insurance policies always pay out When will life insurance not pay out

Choosing the right life insurance policy can be overwhelming. There is a wide range of options and selecting the right one for your life is complex. Understanding the types of life insurance policies available and know the facts can help you make the right decision.

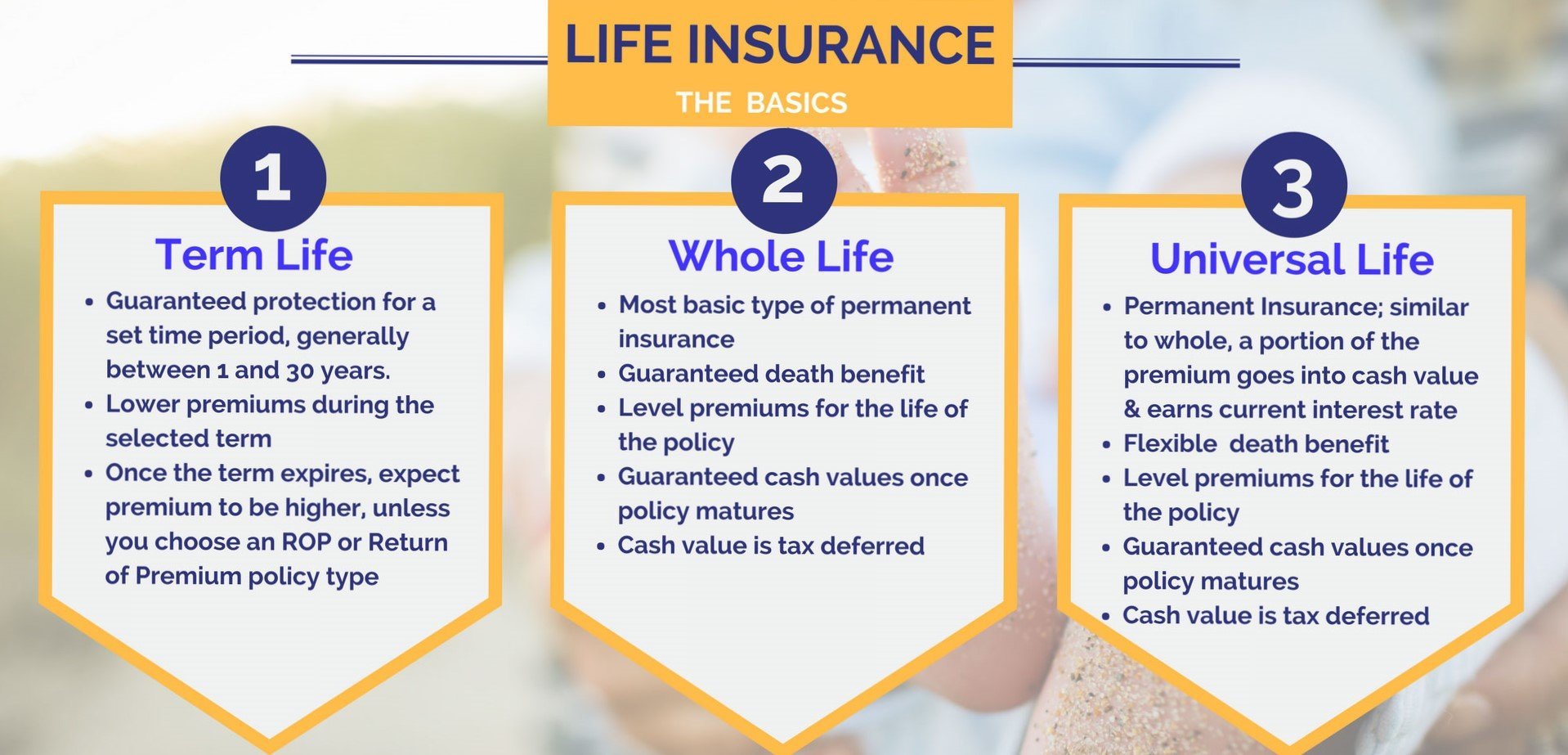

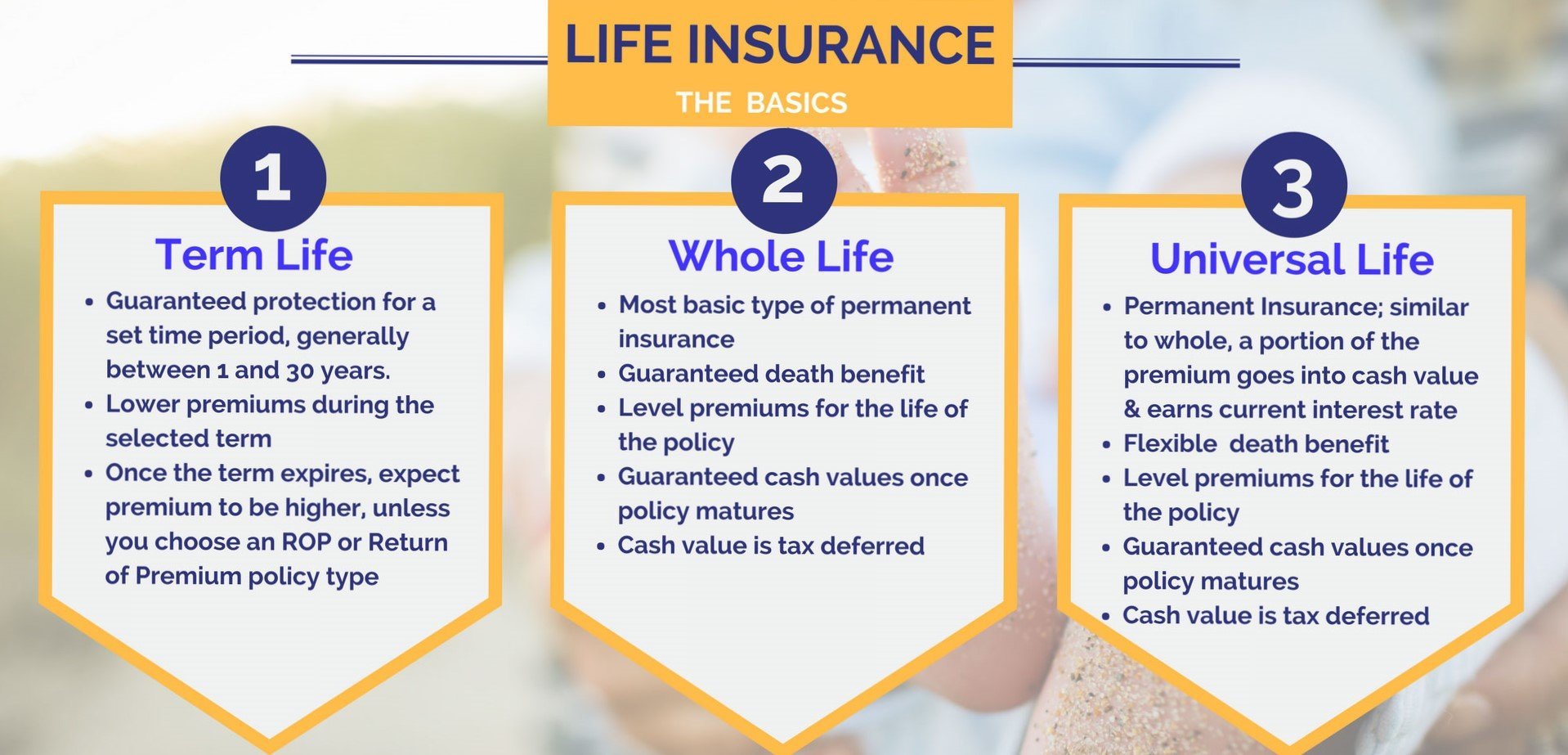

Types Of Life Insurance Policies Explained

At its most basic, life insurance is a policy that pays out a sum of money to a designated beneficiary upon the death of the life insured — usually the policyholder. There are many different types of life insurance and each has its own benefits and drawbacks. Below is a brief overview of the most common types to help you make an informed decision.

- Term Life: A term life insurance policy provides coverage for a set period specified in the contract — 10, 20 or 30 years — and pays out a death benefit to the beneficiary if the insured person dies during the designated term. It offers coverage for a set amount of time and pays no cash value.

- Whole Life: Whole life insurance does not expire, which means that it is intended to cover the insured until death. It accumulates cash value, has fixed rates and can be used as an investment. Whole life policies are usually more expensive than term policies.

- Variable Life: Variable life insurance is similar to whole life insurance, but it allows policyholders to select investments that the cash value portion of the policy is put into. These investments often have higher potential returns than other life insurance policies, but they also offer more risk.

- Universal Life: Universal life insurance is a type of life insurance that is similar to whole life insurance, but it is more flexible. Universal life policies can have adjustable premiums, death benefits and cash values. This makes them a great option for people who want more control over their policy.

- Survivorship: Survivorship life insurance is a type of policy that covers two or more people. Typically, it is used by couples to cover both lives, but it can also cover siblings, parents and children. The policy pays out a death benefit to the designated beneficiary if both people covered by the policy die.

When Will Life Insurance Not Pay Out - 10 Things You May Not Notice

When you choose a life insurance policy, you'll want to make sure that you understand the exclusions and exceptions that can render the policy invalid and leave your beneficiaries with no payout. Here are some of the most common reasons why life insurance will not pay out.

- Suicide: Most life insurance policies will not pay out if the insured individual commits suicide within the first two years of the policy term.

- Misrepresentation Of Risk: If the individual deliberately or unintentionally misrepresents their health or lifestyle in order to obtain a more favourable policy, the insurer may refuse to pay out.

- Failure To Pay Premiums: If the premiums are not paid on time, the life insurance policy will lapse and the insurer will not pay the death benefit.

- Illegal Activity: If the insured

If you are searching about How do life insurance companies make money? | Ratehub.ca you've visit to the right web. We have 7 Pics about How do life insurance companies make money? | Ratehub.ca like When Will Life Insurance Not Pay Out - 10 Things You May Not Notice In, How do Life Insurance Companies Make Money? - Medicare Life Health and also Life Insurance Claims & Payouts in the UK-Infographic-Free Price Compare. Read more:

How Do Life Insurance Companies Make Money? | Ratehub.ca

www.ratehub.ca

www.ratehub.ca Free Printable Life Insurance Policy, Collection By Executor Form (GENERIC)

www.printablelegaldoc.com

executor administration forms printablelegaldoc

How Do Life Insurance Companies Make Money? - Medicare Life Health

medicarelifehealth.com

medicarelifehealth.com companies cummings

When Will Life Insurance Not Pay Out - 10 Things You May Not Notice In

gundy-farm.blogspot.com

gundy-farm.blogspot.com protective

How Do Life Insurance Companies Make Money Reddit - Marcoferreridesign

marcoferreridesign.blogspot.com

marcoferreridesign.blogspot.com budget budgeting moneycanbuymehappiness backwards finances

Types Of Life Insurance Policies Explained

www.easyquotes4you.com

www.easyquotes4you.com insurance types policies explained definition

Life Insurance Claims & Payouts In The UK-Infographic-Free Price Compare

freepricecompare.com

insurance infographic claims payouts pay kindly

Budget budgeting moneycanbuymehappiness backwards finances. When will life insurance not pay out. How do life insurance companies make money?

Comments

Post a Comment