life insurance agent jobs with base salary Agents cannabis houston

Choosing the right insurance coverage can be a tricky process. It often involves comparing countless plans and providers, learning the intricacies of each policy, and getting the perfect balance of cost and coverage. Fortunately, a licensed insurance broker can help make the process easier, providing valuable advice and assistance every step of the way.

The Benefits of a Licensed Insurance Broker

Licensed insurance brokers act as an advocate for the policyholder, providing helpful advice and assistance during the process of selecting and securing the best policy and coverage. They often have specialized knowledge of different products, providers, and policies, so they can quickly and easily compare the available options and provide advice on which option is best suited to you.

Brokers also provide guidance about coverage limits, deductibles, and other important aspects of an insurance policy. In addition, as an independent broker, they have access to a number of different providers and plans, allowing them to tailor a policy to your specific needs and budget. In most cases, a broker will have the benefit of long-term relationships with trusted providers, allowing them to negotiate better deals on behalf of customers.

Choosing the Right Broker for You

When selecting a broker, it's important to examine their qualifications, experience, and industry reputation. The broker should be licensed and experienced in the type of insurance you need, as well as familiar with the relevant laws and regulations. In addition, they should be someone you trust and feel comfortable talking to, as the relationship between broker and policyholder is often an ongoing one.

In addition to researching the qualifications of a potential broker, it's also important to find out about the services and fees associated with their work. Many brokers offer free consultations, so you can get a better understanding of their approach to the insurance process and your individual needs. It's important to understand the full cost of their services, as well as any related fees, before signing any agreements.

While the insurance process can sometimes be overwhelming, a licensed insurance broker can help provide the knowledge and support you need to make the right choices and get the best coverage. And if you're looking for life insurance quotes, an independent agent is your best option. They'll be able to provide you with insights into the latest products and provide you with tailored coverage and competitive rates to meet your needs.

If you are looking for Average Salary Of A Life Insurance Agent - Keijgoeskorea you've came to the right place. We have 7 Pics about Average Salary Of A Life Insurance Agent - Keijgoeskorea like Country Financial Insurance Agent Salary, 8 Resources Every Insurance Agent Should Know About in 2021 and also Life Insurance Agent Salary 2019 : すごい 2017 Pdf Lic Agent Commission. Read more:

Average Salary Of A Life Insurance Agent - Keijgoeskorea

keijgoeskorea.blogspot.com

keijgoeskorea.blogspot.com broker brokers

Life Insurance Agent Salary 2019 : すごい 2017 Pdf Lic Agent Commission

hot-trendings.yyzhu.net

hot-trendings.yyzhu.net 8 Resources Every Insurance Agent Should Know About In 2021

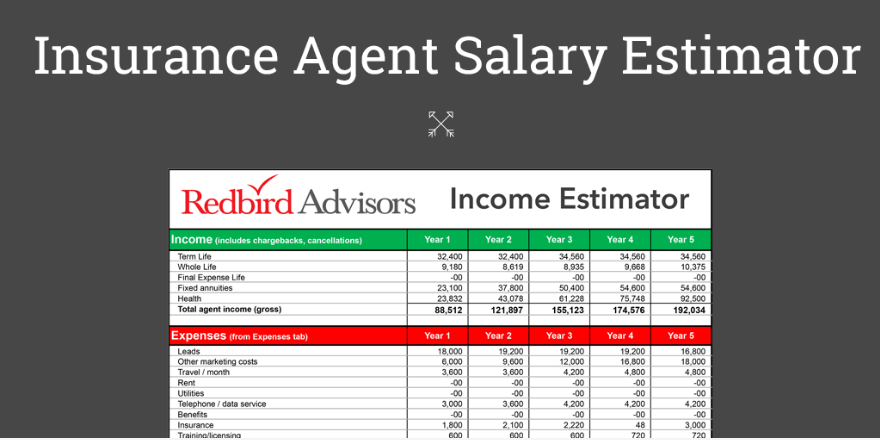

redbirdagents.com

redbirdagents.com Country Financial Insurance Agent Salary

design-kuznetcov.blogspot.com

design-kuznetcov.blogspot.com everquote

Why An Independent Agent Is Your Best Option For Life Insurance Quotes

icainsurance.com

icainsurance.com agents cannabis houston

Life Insurance Agent Salary - YouTube

www.youtube.com

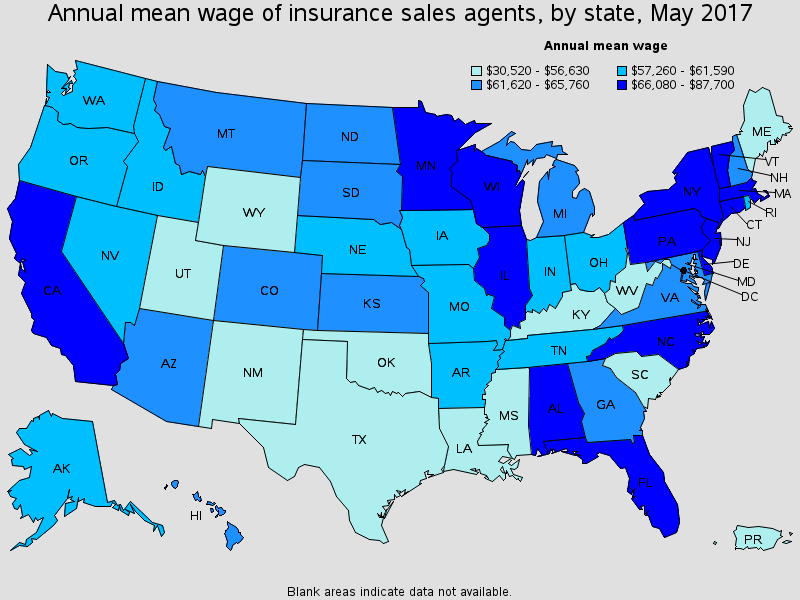

www.youtube.com insurance agent salary

Licensed Insurance Broker Job Description - All Information About

imbillionaire.net

imbillionaire.net thebalancecareers license

Why an independent agent is your best option for life insurance quotes. 8 resources every insurance agent should know about in 2021. Life insurance agent salary

Comments

Post a Comment